News, Updates & Resources

Make An AppointmentFamilies: 2017 Year End Tax Tips

Calculating and figuring out how much tax you have to pay is nobody’s favorite time of the year, but if you plan carefully there are many tactics available at your disposal to make sure that your tax bill is not more than it has to be in 2017. Which tactics make the most sense can be figured out by analyzing your current finances, estimating your tax situations and identifying financial transaction that might take place either this year or next year. You should get started now, and consider these tax tips for families to consider before Dec. 31, 2017.

Paying for Education

Post-secondary education can be expensive, however having the opportunity to plan for it helps with making sure that you’re capable to meet the costs of education. In addition, when you have a plan, it’s easer to make financial decisions that align with your goals and provide peace of mind.

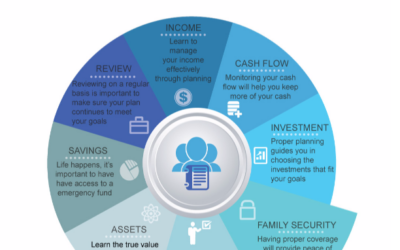

The Importance of a Financial Plan

The importance of a financial plan. Working with us to create your financial plan helps you identify your long and short term life goals.Talk to us to see how we can help you.

Updated Small Business Tax Reforms

It has certainly been a busy week in terms of announcements regarding financial policies for small businesses. Following the series of proposed tax reforms that the government announced back in July, various tweaks and changes have subsequently been made, owing, perhaps in part, to confusion and frustration expressed among the small business community. We have provided a brief summary of the changes in this article and infographic.

How to Make the Best of Inheritance Planning

Inheriting an unexpected, or even an anticipated, lump sum can fill you with mixed emotions – if your emotional attachment to the individual who has passed away was strong then you are likely to be grieving and the thought of how to handle your new-found wealth can be overwhelming and confusing but also exciting.

Paying for Medical Expenses

Although we enjoy health care benefits in Canada, there are still some benefits that are not covered by the government. We outline strategies to pay for these benefits.

Contact

Phone

905-206-0900

Address

5025 Orbitor Drive Building 3 Suite 300

Mississauga, ON L4W 4Y5