News, Updates & Resources

Make An Appointment2019 Financial Calendar

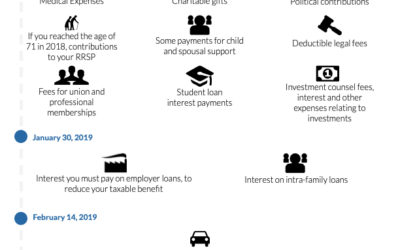

Financial Calendar for 2019- All the deadlines you need to know to maximize your benefits!

Tax Planning Tips for End of 2018

Now that we are nearing year end, it’s a good time to review your finances. 2018 saw a number of major changes to tax legislation come in force and more will apply in 2019, therefore you should consider available opportunities and planning strategies prior to year-end.

Estate Planning for Business Owners

Writing an estate plan is important if you own personal assets but is all the more crucial if you also own your own business. This is due to the additional business complexities that need to be addressed, including tax issues, business succession and how to handle bigger and more complex estates. Seeking professional help from an accountant, lawyer or financial advisor is an effective way of dealing with such complexities.

Retirement Planning for Business Owners

Retirement planning can be a complex process for us all, but if you are the owner of a small business it may can get even more complicated, due to the various factors and circumstances that you have to take into consideration. A common mistake made by small business owners is reinvesting extra money to grow their business, at the expense of putting it aside to save for their retirement.

Why provide an employee benefits plan?

Business owners are increasingly recognizing the key importance of implementing employee benefit plans in their organization

Financial Planning for Incorporated Professionals

Financial planning for incorporated professionals is often two-sided- planning for the practice and personal financial planning.

Contact

Phone

905-206-0900

Address

5025 Orbitor Drive Building 3 Suite 300

Mississauga, ON L4W 4Y5