News, Updates & Resources

Make An AppointmentWellCan – A new app available to support mental health during COVID-19

Struggling to cope with COVID-19?

WellCan.ca provides free digital mental health resources for Canadians online and through their Apple Appstore app.

Applications for the Canada Emergency Business Account starts TODAY!

The new Canada Emergency Business Account (CEBA) is available starting TODAY and is available through major banking institutions.

The CEBA will provide qualifying businesses an interest-free loans of up to $40,000 until December 31, 2022.

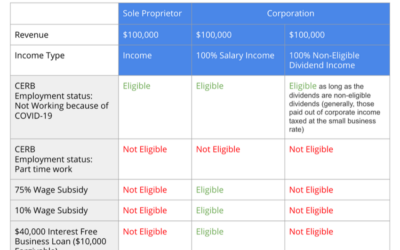

Rules changed to allow more struggling business owners access to CERB, Wage Subsidy. Summer jobs program increased to 100%

A big win today for some small business owners who previously did not qualify for the $500/week Canada Emergency Response Benefit (CERB) or the 75% Canada Emergency Wage Subsidy (CEWS).

Ontario Support for Families portal is LIVE!

Today, Ontario launched the portal for parents to apply for a one-time COVID-19 payment to help offset the costs of keeping children entertained and engaged during this time away from school.

Under this new program, parents are eligible for a one-time per child payment of:

$200 for children aged 0 to 12

$250 for children or youth aged 0 to 21 with special needs

Accepting Applications starting April 6th – Canada Emergency Response Benefit (CERB)

The sheer volume of applications for the Canada Emergency Response Benefit (CERB) will likely overwhelm the system. If you or someone you know need to apply for this benefit, we suggest you prepare TODAY before the applications begin:

Double check your myCRA account username and password

Setup Direct Deposit with CRA

Tax Loss Selling

Over the last few weeks, the financial market has taken a downturn amidst fears over Coronavirus.

Understandably, you are concerned with your portfolio, it’s important to stay level-headed to avoid making financial missteps. However, staying level-headed doesn’t necessarily mean you sit there and do nothing. In fact, one consideration you can look is taking an active tax management approach.

Tax loss selling is a strategy to crystallize or realize any capital losses in your non-registered accounts so it can be used to offset any capital gains.

Contact

Phone

905-206-0900

Address

5025 Orbitor Drive Building 3 Suite 300

Mississauga, ON L4W 4Y5