by Sabre Strategic Partners | Feb 1, 2019 | Blog, Family, Individuals, Investment, Retirees, RRSP, tax, Tax Free Savings Account

If you are seeking ways to save in the most tax-efficient manner available, TFSAs and RRSPs can both be effective options for you to achieve your savings goals more quickly. However, each plan does have distinct differences and advantages / disadvantages. Let’s take a...

by Sabre Strategic Partners | Jan 21, 2019 | Family, Individuals, Investment, Retirees, RRSP, tax, Tax Free Savings Account

If you are seeking ways to save in the most tax-efficient manner available, TFSAs and RRSPs can both be effective options for you to achieve your savings goals more quickly. However, each plan does have distinct differences and advantages / disadvantages. Let’s take a...

by Sabre Strategic Partners | Nov 30, 2018 | Blog, Estate Planning, Family, Individuals, pension plan, Retirees, RRSP

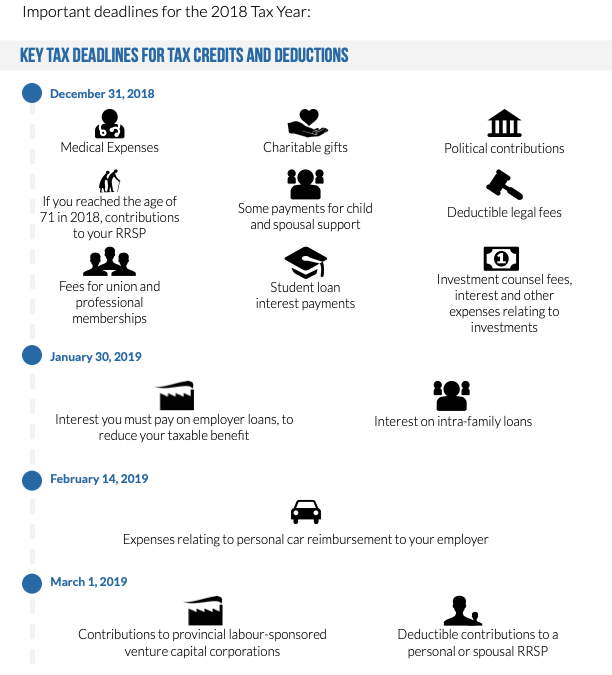

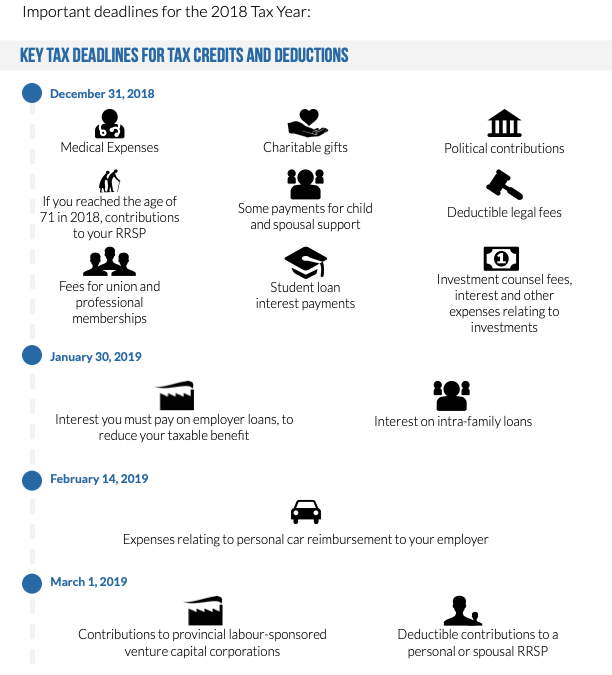

Now that we are nearing year end, it’s a good time to review your finances. 2018 saw a number of major changes to tax legislation come in force and more will apply in 2019, therefore you should consider available opportunities and planning strategies prior to...

by Sabre Strategic Partners | Oct 1, 2018 | Blog, Business Owners, corporate, Retirees, RRSP, tax, Tax Free Savings Account

Retirement planning can be a complex process for us all, but if you are the owner of a small business it may can get even more complicated, due to the various factors and circumstances that you have to take into consideration. A common mistake made by small business...

by Sabre Strategic Partners | Apr 3, 2018 | Blog, Business Owners, corporate, dental benefits, Estate Planning, Family, Group Benefits, Individuals, Investment, Retirees, tax

The 2018 Ontario budget features a number of new measures and billions of dollars of enhanced spending across the spectrum, as announced by the province’s Finance Minister, Charles Sousa. Read on for some of the key proposals.PersonalEliminate SurtaxA new sliding...

by Sabre Strategic Partners | Mar 7, 2018 | Blog, Charitable Gifting, disability, Family, Individuals, Investment, Retirees, RRSP, tax

It’s that time of year again, when many of us sit down to complete our income tax return and hope that we have done enough preparation to ensure a smooth and speedy process. Unfortunately, there are a number of complexities that can cause us problems – here are a few...