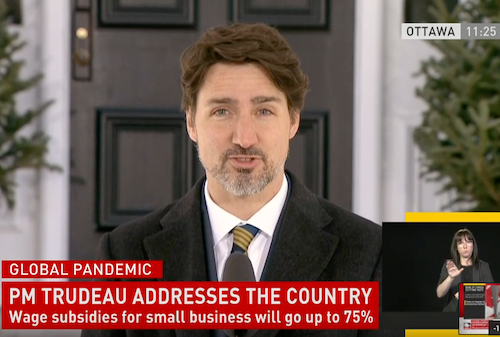

March 27, 2019 – Prime Minister Justin Trudeau announced programs and measures focused on helping Small & Medium Sized Businesses and Entrepreneurs cope with the economic consequences caused by the COVID-19 pandemic.

“With these new measures, our hope is that employers being pushed to laying off people due to COVID-19 will think again,” Trudeau said. “And for those of you who have already had to lay off workers, we hope you will re-hire them.”

Wage Subsidy increased to 75%

The Prime Minister has been under pressure from the small business community to boost the wage subsidy beyond the 10% initially announced to help keep people employed. Today, Mr. Trudeau announced the government will increase the wage subsidy from 10% to 75% to help keep employees on the payroll. This increase will be backdated to Sunday, March 15th.

“It is clear we have to do more, much more so we are bringing that percentage up to 75 per cent for qualifying businesses”

– Prime Minister Justin Trudeau

Canada Emergency Business Account (CEBA)

The CEBA will allow banks to offer $40,000 loans that will be interest-free for the 1st year which will be guaranteed by the government. If you meet certain conditions, $10,000 of the loan can be forgivable.

“To help you bridge to better times, we are launching the Canada Emergency Business Account. With this new measure banks will soon offer $40,000 which will be guaranteed by the government”

Defer GST, HST, Duty

The government will defer GST & HST payments, as well as duty and taxes owed on imports until June 2020.

“This is the equivalent of giving $30-billion of interest free loans to businesses”

Bank of Canada Rate Cut

Bank of Canada slashed its key overnight interest rate to 0.25%.

Full details and qualification requirements will be available on Monday.