2019 Federal Budget

The 2019 budget is titled “Investing in the Middle Class. Here are the highlights from the 2019 Federal Budget.

We’ve put together the key measures for:

-

Individuals and Families

-

Business Owners and Executives

-

Retirement and Retirees

-

Farmers and Fishers

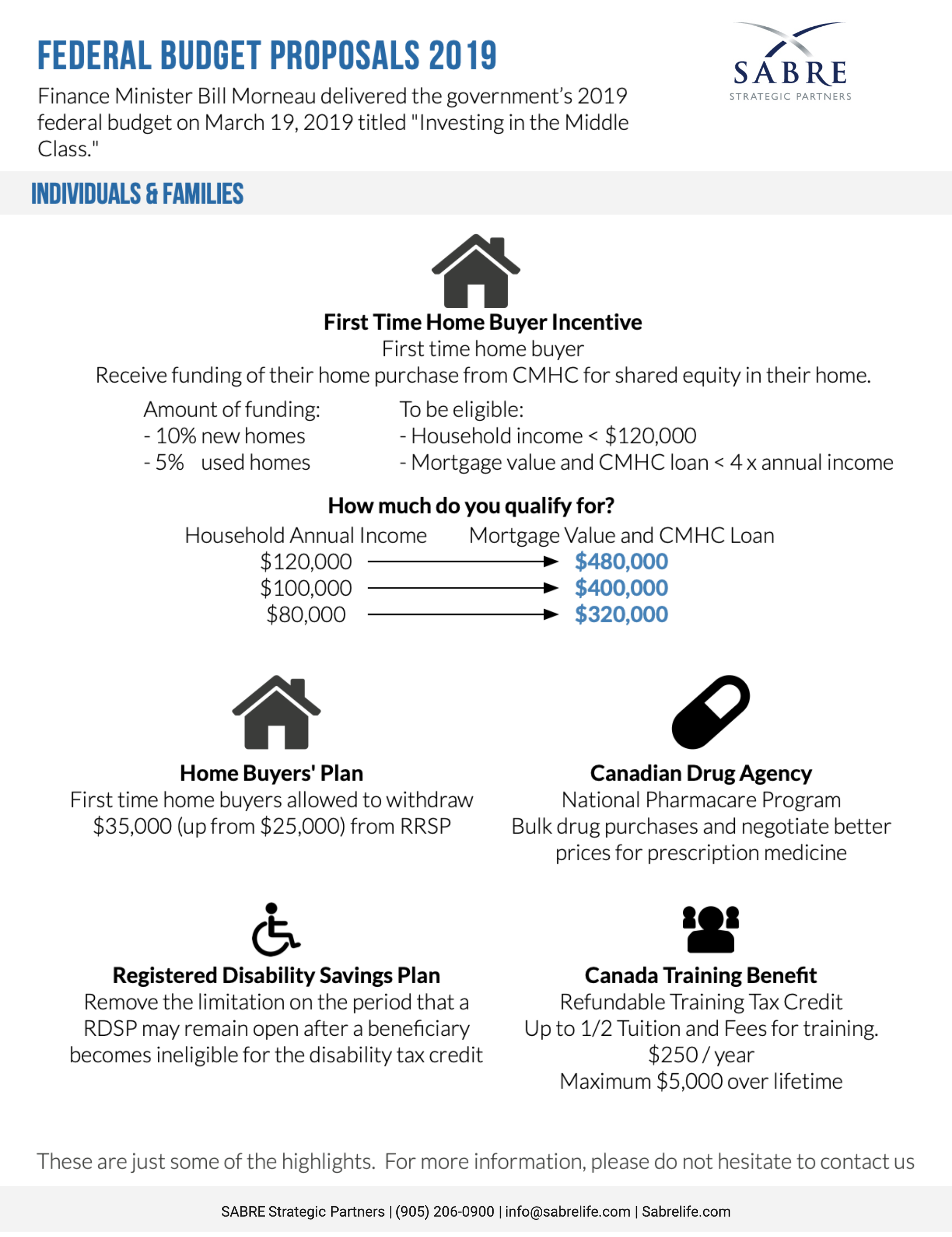

Individuals & Families

Home Buyers’ Plan

Currently, the Home Buyers’ Plan allows first time home buyers to withdraw $25,000 from their Registered Retirement Savings Plan (RRSP), the budget proposes an increase this to $35,000.

First Time Home Buyer Incentive

The Incentive is to provide eligible first-time home buyers with shared equity funding of 5% or 10% of their home purchase price through Canada Mortgage and Housing Corporation (CMHC).

To be eligible:

-

Household income is less than $120,000.

-

There is a cap of no more than 4 times the applicant’s annual income where the mortgage value plus the CMHC loan doesn’t exceed $480,000.

The buyer must pay back CMHC when the property is sold, however details about the dollar amount payable is unclear. There will be further details released later this year.

Canada Training Benefit

A refundable training tax credit to provide up to half eligible tuition and fees associated with training. Eligible individuals will accumulate $250 per year in a notional account to a maximum of $5,000 over a lifetime.

Canadian Drug Agency

National Pharmacare program to help provinces and territories on bulk drug purchases and negotiate better prices for prescription medicine. According to the budget, the goal is to make “prescription drugs affordable for all Canadians.”

Registered Disability Savings Plan (RDSP)

The budget proposes to remove the limitation on the period that a RDSP may remain open after a beneficiary becomes ineligible for the disability tax credit. (DTC) and the requirement for medical certification for the DTC in the future in order for the plan to remain open.

This is a positive change for individuals in the disability community and the proposed measures will apply after 2020.

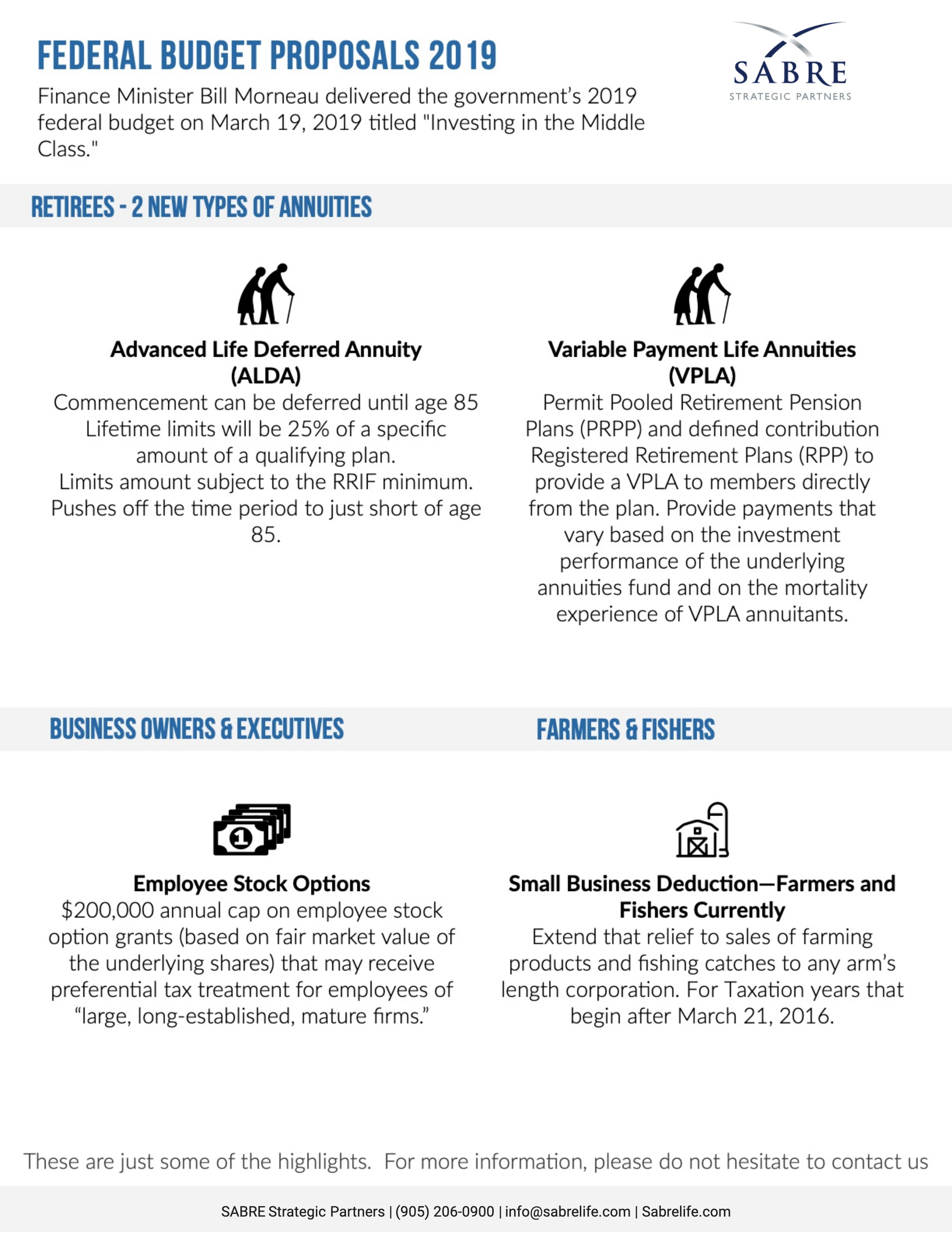

Business Owners and Executives

Intergenerational Business Transfer

The government will continue consultations with farmers, fishes and other business owners throughout 2019 to develop new proposals to facilitate the intergenerational transfers of businesses.

Employee Stock Options

The introduction of a $200,000 annual cap on employee stock option grants (based on Fair market value) that may receive preferential tax treatment for employees of “large, long-established, mature firms.” More details will be released before this summer.

Retirement and Retirees

Additional types of Annuities under Registered Plans

For certain registered plans, two new types of annuities will be introduced to address longevity risk and providing flexibility: Advanced Life Deferred Annuity and Variable Payment Life Annuity.

This will allow retirees to keep more savings tax-free until later in retirement.

Advanced Life Deferred Annuity (ALDA): An annuity whose commencement can be deferred until age 85. It limits the amount that would be subject to the RRIF minimum, and it also pushes off the time period to just short of age 85.

Variable Payment Life Annuity (VPLA): Permit Pooled Retirement Pension Plans (PRPP) and defined contribution Registered Retirement Plans (RPP) to provide a VPLA to members directly from the plan. A VPLA will provide payments that vary based on the investment performance of the underlying annuities fund and on the mortality experience of VPLA annuitants.

Farmers and Fishers

Small Business Deduction

Farming/Fishing will be entitled to claim a small business deduction on income from sales to any arm’s length purchaser. Producers will be able to market their grain and livestock to the purchaser that makes the most business sense without worrying about potential income tax issues. This measure will apply retroactive to any taxation years that began after March 21, 2016.

To learn how the budget affects you, please don’t hesitate to contact us.