Usually our concept of income is derived from labor which leads to a fixed or variable wage for a certain time duration. Another type of income is investment income which results from investing in various financial assets. Investment income can take the form of dividends, interest payments, rent, royalties and capital gains. Investment income is basically money or an asset creating more money without any physical effort, per se, by the investor. The nature of such an income makes it attractive but not risk free. The investment portfolio can consist of savings in physical assets like real estate and commodities or in financial assets like stocks, bonds, and segregated funds etc.

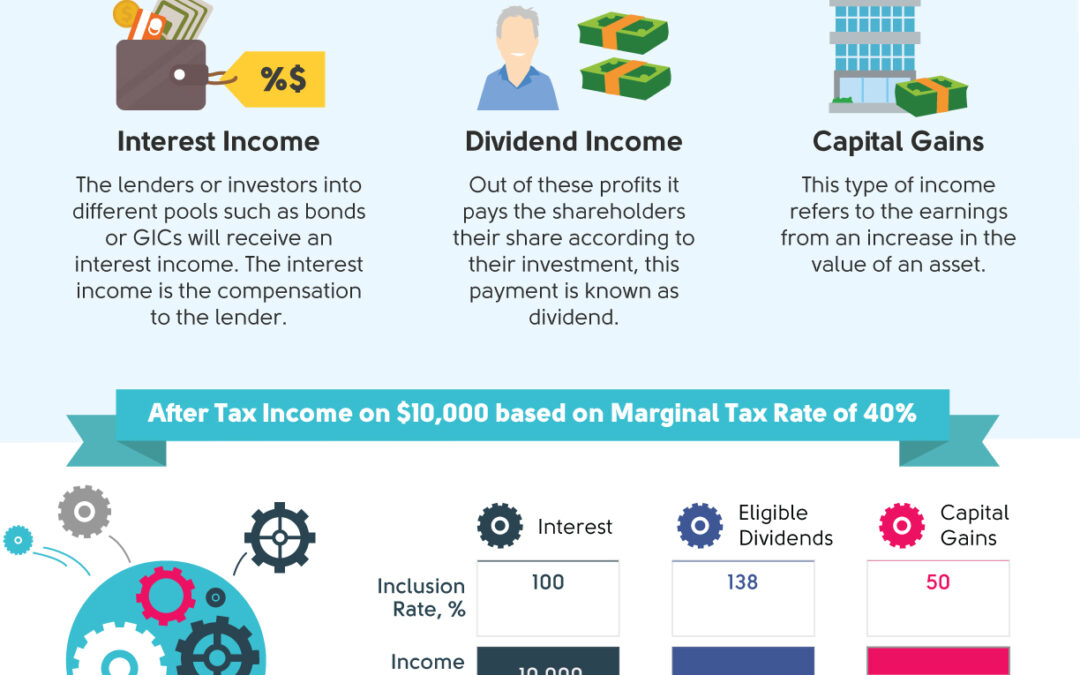

After Tax Income on $10,000 based on Marginal Tax Rate of 40%

| Source of Income | Inclusion Rate ($) | Income Reported on Tax Return ($) | Tax Payable ($) | After Tax Income ($) (MTR:40%) |

| GICs/Bonds (Interest) | 100 | 10,000 | 4,000 | 6,000 |

| Eligible Dividends | 138 | 13,800 | 2,500 | 7,500 |

| Capital Gains | 50 | 5,000 | 2,000 | 8,000 |

Overview of Income

Investment income can be divided into three areas: dividend income, capital gains and interest income. The accrual of these incomes differs by the virtue of their source. By having a diverse investment portfolio the risk of investment can be spread out and an investor can accumulate sizeable profits from these various sources over the course of a defined time period.

Interest Income

The economy functions on the principle of borrowing and lending to perform certain functions. According to the principle a decrease in the value of money over time, the people who lend should be compensated in some way for making their funds available to the borrower. The lenders or investors into different pools such as bonds or GICs will receive an interest income. The interest income is the compensation to the lender. The borrowing company or institution is liable to pay the interest on the defined time to the lender. Interest income is taxable and can accumulate to a sizeable amount overtime depending on one’s initial investment. The individual taxpayer will use the annual accrual method of reporting interest income, in this case the taxpayer has to report the income as it is earned even if it hasn’t been received. The inclusion rate for interest is 100%.

Dividend Income

Companies with shareholders have to pay a certain amount to these investors for putting their money into the business. The shareholders have the option of participating in the company’s affairs or remaining passive, depending on their status. For instance, in private limited companies, shareholders are more involved while in public limited companies there is a divorce between ownership and control and shareholders are more passive.

Nevertheless, the company as a separate legal entity makes profits or losses on an annual basis. Out of these profits it pays the shareholders their share according to their investment, this payment is known as dividend. Thus the money a shareholder’s capital garners over the course of the year is known as dividend income. The corporation is obligated to pay these dividends to the shareholders and the exact time when these dividends are paid can differ according to the type of shares the shareholder has.

Dividends are subject to taxation but in order to avoid double taxation investors can get a dividend tax credit. Adjusting income avoids double taxation of dividend income. Therefore dividends receive preferential tax treatment through the dividend tax credit. Dividends from public corporations qualify as ‘eligible dividends’ and have an inclusion rate of 138% where as non-eligible dividends are included at 125%.

Capital Gains

This type of income refers to the earnings from an increase in the value of an asset. It is basically the difference between the purchase price and the selling price of an asset. Capital gains are only realized at the time of sale; it is therefore not classified as property income because it requires certain amount of effort to sell the asset to earn profits.

Contact us to learn how we can help.